If you possess high-value assets and/or income, you may be worried about how the Florida courts will rule your divorce settlement. Nevertheless, high net worth divorces have a more complex process than that of standard divorces, and thus need to be handled with a higher level of care. Read on to learn if your divorce will fall under that of high net worth, which of your assets and/or income streams are on the table, and how a seasoned Broward County divorce lawyer at The Finizio Law Group can help you protect them.

How does the state of Florida determine a high net worth divorce?

The guidelines that the state of Florida uses to determine a high net worth divorce are rather simple. Similar to most states, if you or your spouse own $1 million or more in net liquid assets, then you must undergo a high net worth divorce.

What assets are at hand in a high net worth divorce?

Like standard divorces, high net worth divorces deal with child support, child custody, and alimony settlements, among others. But since there is much more at stake, high net worth divorces are far more complicated when it comes to property division.

Florida settles property division by referencing equitable distribution laws, which divide marital property in a fair and equitable way. However, such division is more involved due to the complex assets and financial interests at hand. Examples of such assets are as follows:

- Business ownership interests.

- Investment properties, vacation and rental properties.

- Investments, such as stocks, bonds, and debentures.

- Deferred income, such as stocks.

- Retirement assets, such as 401(k)s and pensions.

- Antiques, artwork, and memorabilia.

- Expensive cars and jewelry.

With that being said, forensic accountants are found to be necessary for the property division in a high net worth divorce. This is because it is possible that your spouse may be hiding assets to keep more than what is fair. The accountant will prevent this by reviewing tax returns, credit card statements, property deeds, and stocks, among others.

If you need further assistance with handling the high net worth divorcee process, do not hesitate in reaching out to a knowledgeable Broward County family law attorney today. We will consult with forensic accountants and other experts on your behalf.

How do I avoid losing my assets in a high net worth divorce?

If you are not yet married, a precautionary measure that may be in your best interest is drafting a prenuptial agreement with your future spouse. As a high-net individual, this document will allow you to outline what property belongs to which spouse. If you are already married, you may consider drafting a postnuptial agreement.

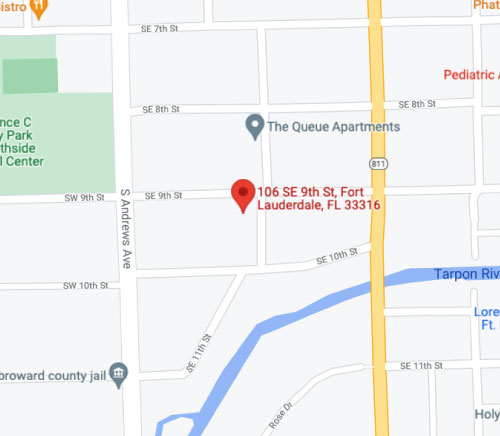

Contact Our Experienced Broward County Firm

If you require legal representation for matters of personal injury, family law, criminal defense, commercial litigation, or aviation litigation, contact The Finizio Law Group today.